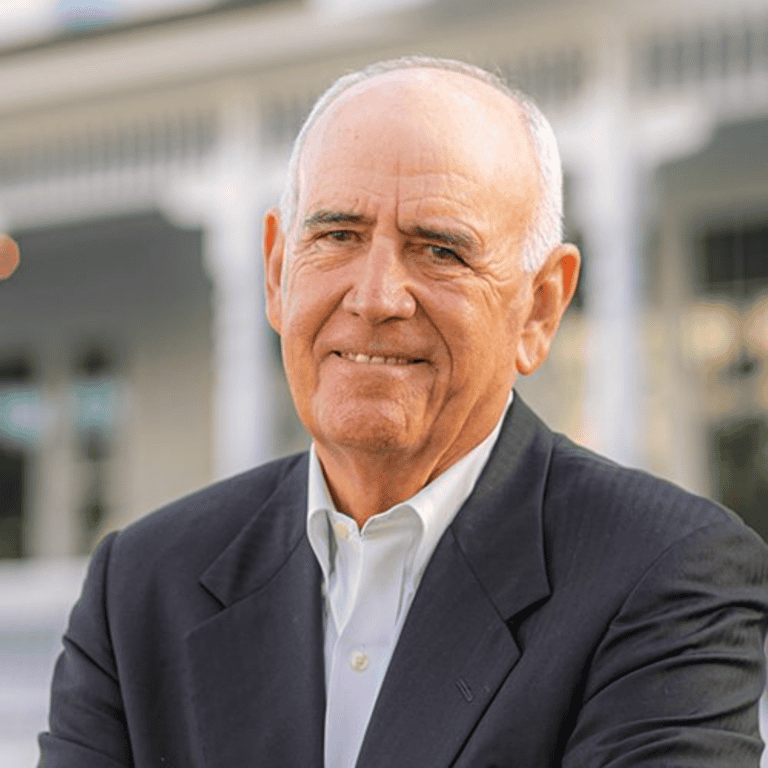

Dr. Barb Provost

Dr. Barb Provost, founder of Purse Strings, a trailblazing initiative designed to arm women with the financial tools and confidence they need to make smart money moves. Through Purse Strings, Dr. Barb provides financial education and resources to women and access to a nationwide directory of vetted financial professionals who are uniquely qualified to serve the women’s market.

With a doctorate in adult learning and decades of experience in financial services, Dr. Barb is a recognized expert on women and money. She specializes in teaching financial professionals how to reach, engage, and earn the female dollar—helping them grow their business while better serving this powerful and often underserved market. She brings sharp insight, a no-nonsense approach, and a whole lot of heart to every conversation.